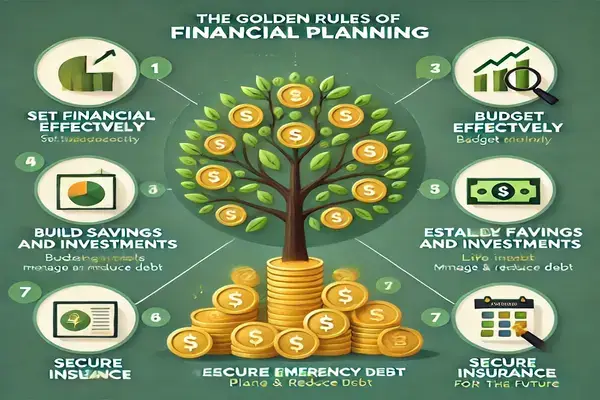

What Are the Golden Rules of Financial Planning?

Financial planning is the heart of all real lived life. If you have no plan, you can soon find yourself paying off debt, losing out on chances, and not living your dreams. But what are these golden rules of financial planning, and how can they change the financial game for you?

This guide distills the important principles you need to follow to manage your money well. From establishing achievable goals to making knowledgeable investment choices, we will discuss techniques for guaranteeing your financial stability and autonomy.

Key Takeaways

- Long-term stability and security can only be achieved through proper financial planning.

- These guidelines can be a combination of budgeting, saving, investing, and risk management.

- Even practical tools, such as automated financial advisers, can simplify planning.

- It takes discipline, it takes flexibility and it takes being clear on what you want from yourself.

The Foundation: Why Financial Planning Matters

Financial planning is more than budgeting and saving for the rainiest of days. You’ve got to make your resources support your aspirations. A Financial Planning Association study found that having a financial plan improved your chance of achieving your life goals compared with no plan at all by 42% (2023).

Key benefits of financial planning:

Helps avoid unnecessary debt.

Creates a roadmap for future goals.

Prepares for Emergencies – Eases Financial Stress

“Not having a plan is already scheduled to lose.” – Benjamin Franklin

First, know where you stand financially. Get a grip on your situation, use net worth calculators.

Golden Rule #1: Spend Less Than You Earn

This foundational idea is the backbone of financial success. It’s so easy, yet 60 percent of Americans live paycheck to paycheck, according to CNBC. I encourage you to read more about this blog here: What Are the 5 Steps of Financial Planning?

How to follow this rule:

Be tracking what’s coming in and going out: Download an app such as Mint or YNAB and see if you can figure out a workable budget.

Reduce superfluous spending: Go through your spending each month and slice the scraps away.

50/30/20: Needs get 50%, wants get 30%, savings get 20%.

Tip: Automate transfers to savings so that you are constantly putting money away from your active spending cash.

Golden Rule #2: Save for an Emergency Fund

As much as we may know, life cannot be in a person’s hands, and sudden emergencies may tend to rock even the best-planned financial plans. This all explains, at least in part, why experts say to keep an emergency fund that’ll carry you for 3–6 months’ worth of living expenses.

Steps to build an emergency fund:

Get your fund in a high-yield savings account.

Establish realistic savings goals each month.

Avoid touching the fund except for genuine emergencies.

Pro Tip: If saving seems like a lot of work, start small. Just $10 a week yields $520 in a year.

Golden Rule #3: Invest for the Future

Saving is important and you should always save but investing is what can cause your money to grow for the long term. Historical data shows that the S&P 500 has historically provided an average annual return between 7-10%, well outpacing inflation.

Best practices for investing:

That the earlier you start the more power of compounding you can take advantage of.

Invest in stocks, bonds and other assets to diversify.

Monitor your investments, and rebalance them periodically.

For instance, a $200 a month safe investment return payment puts together over $240,000 in thirty decades at a 7% attention.

Golden Rule #4: Manage Debt Wisely

Debt has its place — if you can manage it. High-interest debts, particularly credit cards, can snowball into financial ruin rapidly.

Prioritize paying off high-interest debts (avalanche method).

Where possible, consolidate debts to one lower-interest loan.

Live within your means and always avoid unnecessary debt.

Table: Strategies for Debt Repayment

Method Description Best For

Snowball: Pay off smallest debts first for motivation. Small, manageable debts

Avalanche: Pay off highest-interest debts first to save money. Large, high-interest debts

Consolidation Combine debts into one lower-interest loan. Multiple high-interest debts

Golden Rule #5: Protect Your Assets

If you are not well–prepared, you could find yourself through a financial crisis as a result of an accident, a natural disaster, a disease or anything and you may feel the seismic shifts. Insurance provides a form of safety net.

Essential types of insurance:

Health insurance: Pays for medical expenses.

Life insurance: Pays your family for its loss if you’re gone.

Home and auto insurance: Safeguards valuable assets.

Disability: Pays you income if you can’t work.

Did you know? More than 70% of Americans can’t afford enough life insurance, leaving families bitterly exposed in an emergency.

Golden Rule #6: Plan for Retirement

Planning for your retirement will allow you to retire when you want and still be able to live the type of lifestyle you like, or to be financially independent. The earlier you start the less you need to save a month.

What you can do to shield your retirement:

- Fully fund all of your retirement accounts: Your 401(k), your IRA, a Roth IRA.

- Supercharge matches: If your employer has a matching contribution, take advantage of free money.

- Maximize contributions each year: Not familiar with the saying, “It takes money to make money!”

As in: The person who maxes out $500 a month to a Roth IRA and earns a 6 percent return every year will have just about half a million dollars — all because of a couple simple monthly checks — in 30 years.

Golden Rule #7: Review and Adjust Your Plan Regularly

Financial plans are not static. Regular reviews ensure they remain aligned with your goals and changing circumstances.

When to review your financial plan:

Annually or semi-annually.

After major life events (marriage, childbirth, career changes).

During economic shifts or changes in financial laws.

Checklist for reviews:

Update your budget.

Consider your insurance needs.

Re-balance your investment portfolio.

Set new goals if needed.

Common Mistakes to Avoid in Financial Planning

Despite the best of intentions, individuals make grievous errors in financial planning all the time.

Top mistakes to avoid:

Ignoring inflation: Ensure your savings outpace inflation.

Making investments late: Postponing investments decreases the benefits of compounding.

Ignoring insurance: Insurance coverage is essential because failure to have coverage can result in a devastating financial loss.

Failing to seek expert advice: A financial advisor can provide tailored guidance.

Conclusion

The golden rules of financial planning—spend less than you earn, save for emergencies, invest wisely, manage debt, and protect your assets—are timeless principles and truly the roadmap to liberty. These rules will help you lay the foundation of a safe and secure future for you and your family.

FAQs on Financial Planning Golden Rules:

Identify the first step in the financial planning process?

Phase 1: Your Current Personal Financial Situation (Income & Expenses, Net Worth) — data as of October 2023.

How much do I need to have saved for retirement by now?

The minimum goal should be at least 15-20 percent of income, more if you want a larger nest egg for when and if you retire. The avalanche (pay off the highest interest rate first) vs the snowball (the small reprieve) — depends on if you want to save cash in the long term or have a series of accomplishments sooner.

Should I get a financial adviser in my life?

Not required, but a financial planner can help customize a plan to your particular needs and goals.

How often should you review your financial plan?

At least annually or after a major life event.

Learn More About What Are the Golden Rules of Financial Planning from makebetterfinance